Solar Financing 101

Going solar can be a great investment that simultaneously lowers your electricity expense while increasing the value of your home. Choosing how to pay for that investment can be daunting with a variety of different products offered in the market. This guide is intended to help you understand solar financing from an unbiased source. Remember, not every solar company offers every solar financing product and while there is often significant benefit to financing your solar array through your contractor’s selected finance company, sometimes it's worth considering other products and services.

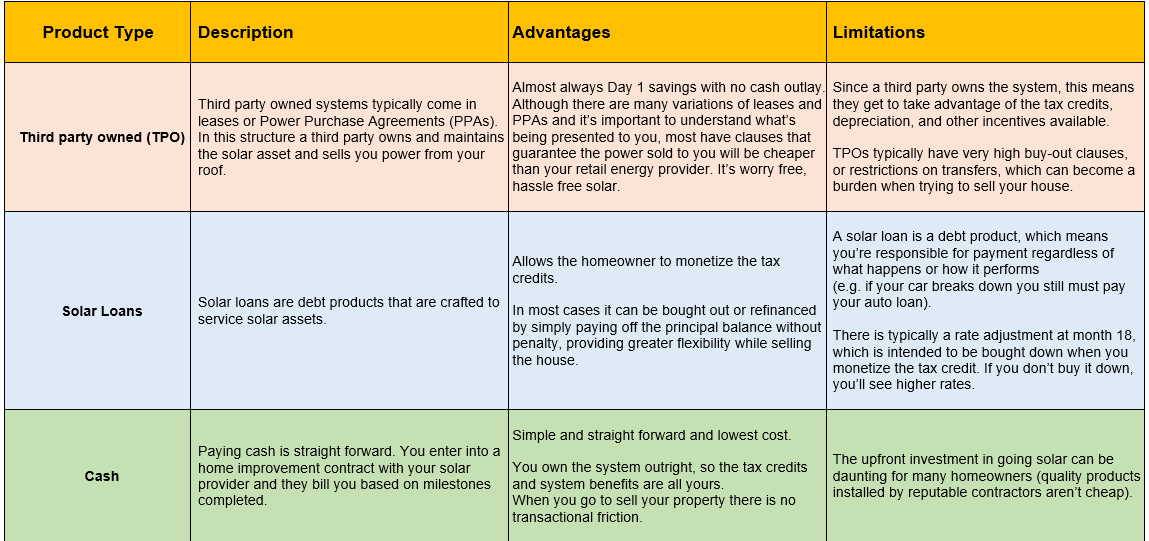

There are three broad categories for financing residential solar. Here are key things to know about each financing type:

There is no single right answer to this question. Consider each financing product carefully and weigh it against your individual goals and plans.

As a quick rule of thumb: if you can efficiently monetize the tax credit* and you’re comfortable with solar as a technology – consider a cash or loan transaction first.

If you have insufficient active tax liabilities to efficiently monetize the tax credit – consider a TPO first.

*If you’re not sure, speak with your tax professional or your accountant. There can be subtle nuances to individual tax returns and tax credit eligibility that are unique to you and so it’s always best practice to check with a professional.

There are! Speak with your solar professional consultant about other products that might be available in your area. You should also reach out to your primary bank or local Federal Credit Union to check their rates or consider a HELOC or borrowing against a retirement vehicle like a 401(k). Many homeowners opt for a hybrid approach where they might pay a large deposit upfront to reduce the amount being financed.